The double entry accounting system records each transaction twice, a fundamental principle that ensures the accuracy and integrity of financial records. This system, widely adopted by businesses and organizations, plays a crucial role in maintaining transparency, preventing errors, and providing a comprehensive view of financial activities.

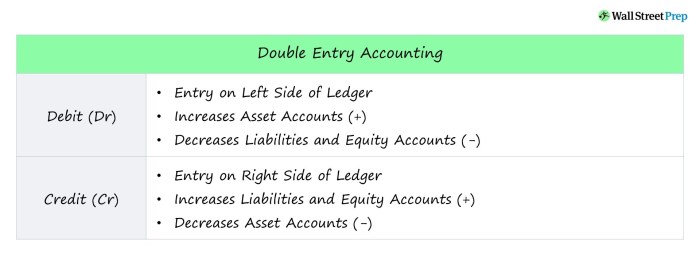

The double entry system operates on the principle of duality, where every transaction affects at least two accounts. For each transaction, an equal debit entry is recorded in one account, and an equal credit entry is recorded in another. This ensures that the accounting equation (Assets = Liabilities + Equity) remains balanced, providing a reliable foundation for financial reporting.

Overview of Double Entry Accounting System

The double entry accounting system is a method of recording financial transactions that ensures the accounting equation (Assets = Liabilities + Equity) remains balanced after each transaction. It involves recording each transaction twice, once as a debit and once as a credit, in order to provide a complete and accurate picture of the financial activities of a business.

The fundamental principles of the double entry accounting system include:

- Every transaction affects at least two accounts.

- The total debits must always equal the total credits.

- The accounting equation must remain balanced after each transaction.

Benefits of Double Entry Accounting

The double entry accounting system offers numerous advantages, including:

- Accuracy:By recording each transaction twice, the system provides a built-in check for errors.

- Reduced Errors:The double entry system helps to reduce errors by ensuring that the total debits always equal the total credits.

- Simplified Record-Keeping:The system provides a clear and organized record of all financial transactions, making it easier to track and manage the financial activities of a business.

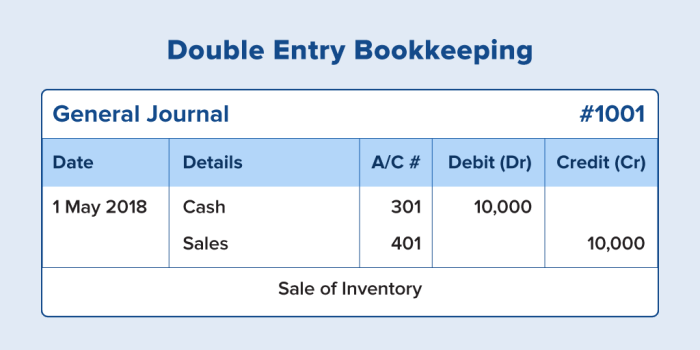

Recording Transactions

Under the double entry accounting system, transactions are recorded in a journal, which is a chronological record of all financial transactions. The journal entries are then posted to the appropriate ledger accounts. A ledger is a collection of accounts that are used to track the balances of various assets, liabilities, equity, revenues, and expenses.

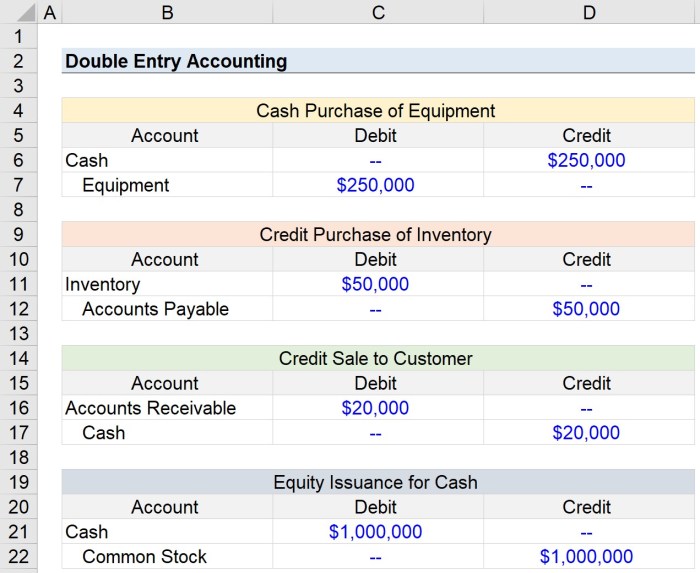

When recording a transaction, it is important to identify the accounts that are affected and the amount of the debit and credit entries. The following table provides examples of debit and credit entries for various types of transactions:

| Transaction | Debit | Credit |

|---|---|---|

| Cash received from sales | Cash | Sales Revenue |

| Equipment purchased | Equipment | Cash |

| Wages paid to employees | Wages Expense | Cash |

Balancing the Accounting Equation: The Double Entry Accounting System Records Each Transaction Twice

The accounting equation (Assets = Liabilities + Equity) is a fundamental concept in accounting. The double entry accounting system ensures that the accounting equation remains balanced after each transaction.

For example, if a company purchases equipment for $1,000, the following journal entry would be recorded:

| Account | Debit | Credit |

|---|---|---|

| Equipment | $1,000 | |

| Cash | $1,000 |

This transaction increases the Equipment asset account by $1,000 and decreases the Cash asset account by $1,000. As a result, the accounting equation remains balanced.

Financial Statements

The double entry accounting system is used to generate financial statements, which provide a snapshot of the financial health of a business. The three main financial statements are the balance sheet, income statement, and cash flow statement.

The balance sheet shows the assets, liabilities, and equity of a business at a specific point in time. The income statement shows the revenues and expenses of a business over a period of time. The cash flow statement shows the inflows and outflows of cash over a period of time.

Question & Answer Hub

What is the purpose of recording transactions twice in the double entry accounting system?

The double entry system records each transaction twice to ensure that the accounting equation (Assets = Liabilities + Equity) remains balanced. This provides a reliable foundation for financial reporting and prevents errors from going unnoticed.

How does the double entry system prevent errors?

The double entry system helps prevent errors by requiring that each transaction be recorded in at least two accounts. If the debit and credit entries do not balance, an error has likely occurred, making it easier to identify and correct.

What are the benefits of using the double entry accounting system?

The double entry accounting system offers numerous benefits, including enhanced accuracy, reduced errors, simplified record-keeping, and compliance with regulatory requirements. It provides a comprehensive view of financial activities, enabling businesses to make informed decisions and manage cash flow effectively.