If a company purchases equipment costing 4500 on credit, it sets in motion a series of accounting and financial implications that impact the company’s financial statements, tax obligations, and cash flow. Understanding these implications is crucial for making informed decisions about equipment acquisitions and managing their financial consequences effectively.

This comprehensive analysis delves into the intricacies of equipment purchases on credit, exploring their impact on the balance sheet, income statement, tax deductions, cash flow, depreciation schedules, cost of goods sold, and internal control implications. By providing a thorough examination of these aspects, this discussion empowers readers to navigate the complexities of equipment financing and make strategic choices that optimize their financial performance.

Impact on Financial Statements

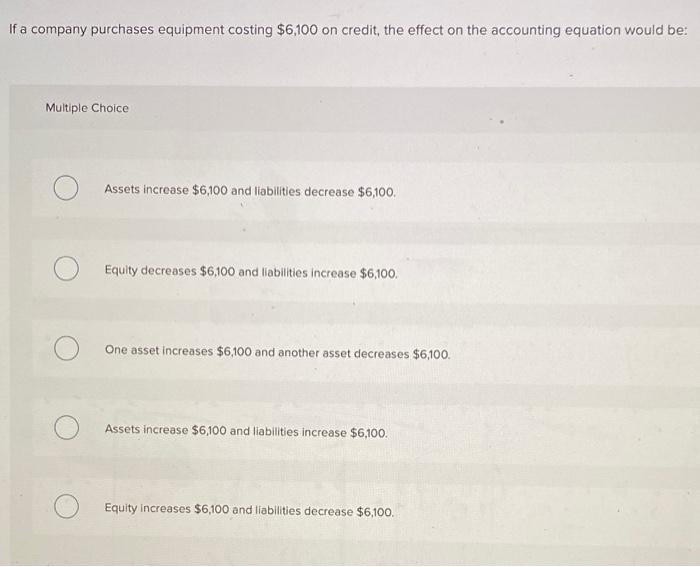

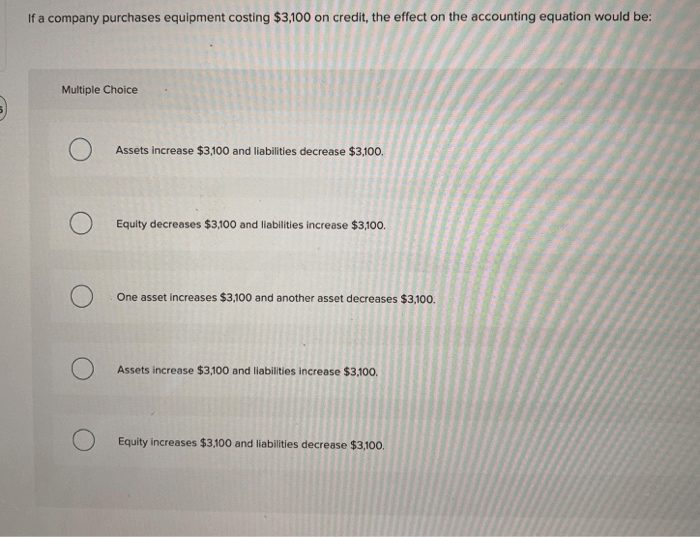

The purchase of equipment on credit affects both the balance sheet and income statement. On the balance sheet, the equipment is recorded as an asset, increasing the company’s total assets. The liability created by the purchase is recorded as an account payable, increasing the company’s total liabilities.

On the income statement, the purchase of equipment does not directly affect revenue or expenses. However, depreciation expense will be recorded in subsequent periods, which will reduce net income.

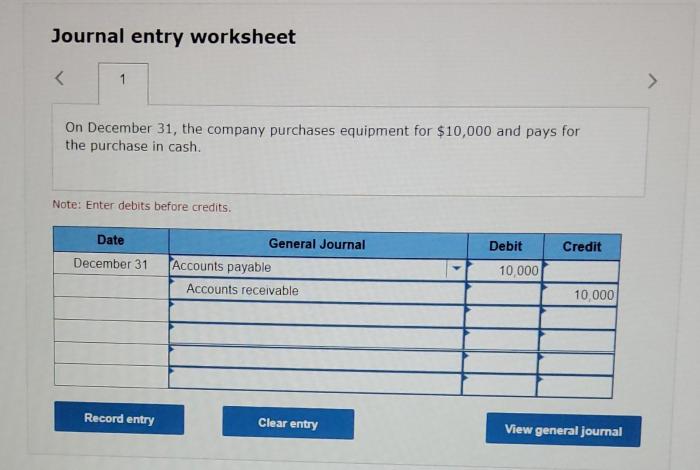

Accounting Treatment of the Transaction

- Debit Equipment for $4,500

- Credit Accounts Payable for $4,500

Tax Implications

The purchase of equipment may have tax implications for the company. The equipment may be eligible for depreciation deductions, which can reduce the company’s taxable income. Additionally, the company may be eligible for investment tax credits, which can further reduce the company’s tax liability.

Potential Deductions or Credits

- Depreciation deductions

- Investment tax credits

Cash Flow Considerations: If A Company Purchases Equipment Costing 4500 On Credit

The purchase of equipment on credit has implications for the company’s cash flow. The company will need to make periodic payments on the account payable, which will reduce the company’s cash balance. Additionally, the purchase of equipment may require the company to invest in additional working capital, such as inventory or supplies, which can further reduce the company’s cash balance.

Potential Financing Options, If a company purchases equipment costing 4500 on credit

- Bank loans

- Equipment leasing

- Vendor financing

Depreciation Schedule

Depreciation is a systematic allocation of the cost of an asset over its useful life. The depreciation schedule for the equipment will depend on the asset’s cost, estimated useful life, and salvage value.

Different Depreciation Methods and Their Impact on Financial Statements

| Depreciation Method | Impact on Financial Statements |

|---|---|

| Straight-line | Depreciation expense is constant over the asset’s useful life. |

| Double-declining balance | Depreciation expense is higher in the early years of the asset’s useful life. |

| Sum-of-the-years’-digits | Depreciation expense is highest in the early years of the asset’s useful life. |

Cost of Goods Sold

The purchase of equipment may affect the company’s cost of goods sold. Depreciation expense is a component of cost of goods sold, and the amount of depreciation expense will vary depending on the depreciation method used.

Calculation of Depreciation Expense and Its Impact on the Income Statement

- Straight-line depreciation: Depreciation expense = (Cost of equipment – Salvage value) / Estimated useful life

- Double-declining balance depreciation: Depreciation expense = (2 – Straight-line depreciation rate) – Book value

- Sum-of-the-years’-digits depreciation: Depreciation expense = (Remaining useful life / Sum of the years’ digits) – (Cost of equipment – Salvage value)

Internal Control Implications

The purchase of equipment has internal control implications for the company. The company needs to ensure that the equipment is properly authorized and documented, and that the equipment is used for its intended purpose.

Need for Proper Authorization and Documentation

- The purchase of equipment should be authorized by a designated employee.

- The purchase of equipment should be documented with a purchase order and invoice.

Answers to Common Questions

What is the accounting treatment for an equipment purchase on credit?

When a company purchases equipment on credit, the transaction is recorded as an increase in the equipment asset account and a corresponding increase in the accounts payable liability account.

How does equipment purchase affect the balance sheet?

Equipment purchases increase the company’s total assets on the balance sheet. The equipment is recorded as a non-current asset, and the accounts payable balance increases under current liabilities.

What are the tax implications of equipment purchases?

Equipment purchases may qualify for tax deductions or credits, depending on the nature of the equipment and the tax laws applicable to the company.