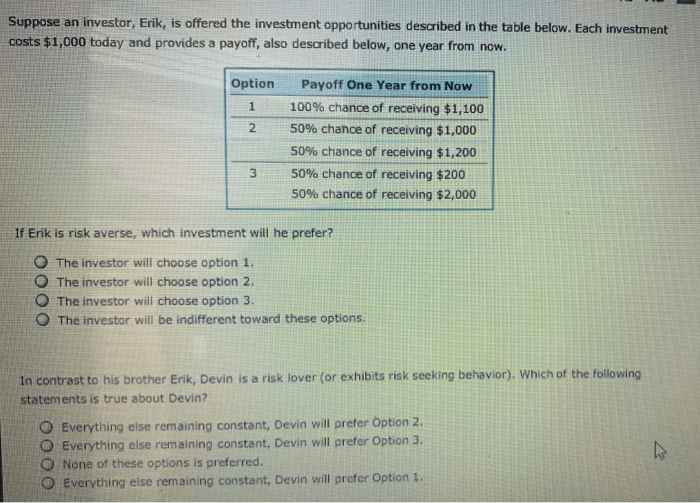

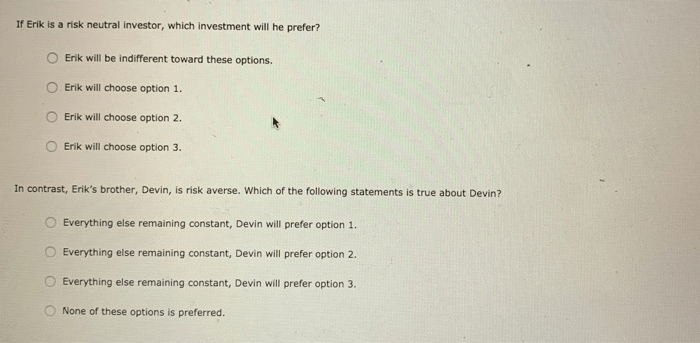

If erik is risk averse which investment will he prefer – Introducing the topic of risk aversion and its impact on investment decisions, this introductory paragraph explores the concept of risk aversion and how it influences the investment choices of individuals like Erik. As we delve into this discussion, we will uncover the various investment options available and the factors that Erik should consider when evaluating them, taking into account his risk aversion.

Erik’s risk aversion will play a significant role in shaping his investment strategy, and we will examine how this aversion affects his evaluation criteria and the recommendations provided for suitable investment strategies. By understanding the relationship between risk aversion and investment preferences, Erik can make informed decisions that align with his financial goals and risk tolerance.

Risk Aversion and Investment Preferences

Risk aversion is a behavioral trait that describes individuals who prefer to avoid uncertainty and potential losses. It influences investment decisions by leading individuals to prioritize investments with lower risk profiles, even if they offer lower potential returns.

Erik, as a risk-averse investor, will likely seek investments that offer stability and minimize the possibility of significant losses. This will shape his investment choices and lead him to favor options with lower volatility and higher preservation of capital.

Types of Investments

- Stocks:Represent ownership in a company and offer the potential for high returns but also carry significant risk.

- Bonds:Loans made to companies or governments that offer fixed interest payments and a return of principal at maturity, with varying levels of risk depending on the issuer.

- Mutual Funds:Diversified portfolios of stocks, bonds, or other investments that provide investors with exposure to a range of assets and reduce risk through diversification.

Evaluating Investment Options, If erik is risk averse which investment will he prefer

Erik should consider several factors when evaluating investment options:

- Investment Horizon:The length of time Erik plans to invest will influence the types of investments he considers.

- Financial Goals:Erik’s financial goals, such as retirement planning or saving for a down payment, will shape his investment strategy.

- Tax Implications:The tax treatment of different investments can impact their overall returns.

Erik’s risk aversion will impact his evaluation criteria by leading him to prioritize investments with lower volatility and higher preservation of capital.

Recommended Investment Strategies

Suitable investment strategies for risk-averse investors like Erik include:

- Diversification:Investing in a range of asset classes, such as stocks, bonds, and real estate, to reduce overall risk.

- Dollar-Cost Averaging:Investing a fixed amount of money at regular intervals, regardless of market conditions, to reduce the impact of market fluctuations.

- Conservative Asset Allocation:Allocating a larger portion of the portfolio to lower-risk investments, such as bonds and money market accounts.

These strategies can help Erik achieve his financial goals while minimizing risk and aligning with his risk-averse investment preferences.

Essential FAQs: If Erik Is Risk Averse Which Investment Will He Prefer

What is risk aversion?

Risk aversion refers to an individual’s tendency to prefer outcomes with lower but more certain returns over outcomes with higher but more uncertain returns.

How does risk aversion affect investment decisions?

Risk-averse investors tend to favor investments with lower risk and more predictable returns, even if the potential returns are lower compared to riskier investments.

What types of investments are suitable for risk-averse investors?

Risk-averse investors may consider investments such as bonds, money market accounts, and low-risk mutual funds that offer lower volatility and more stable returns.